Types of Balance Sheets and Its Formats

Do you know all about the types of balance sheets and their components? Read the article to know all this and more in detail.

A clean balance sheet format is necessary for businesses of all sizes to give stakeholders an idea of the financial position of the business. This article will discuss the various formats of balance sheets that one can encounter. But first, some basics.

What is a Balance Sheet?

A balance sheet is an essential financial statement of a business that indicates its financial position at a given point in time. The balance sheet provides a wealth of information that can be used to analyze the business’s financial stability and business performance.

The business’s investors and creditors use the balance sheet to determine how efficiently the business can use its resources and assets. It is a report version of the accounting equation, i.e., the total of assets is always equal to the total of liabilities plus shareholder’s capital.

Important Components of a Balance Sheet

Here are the two most essential parts of a typical balance sheet –

Assets

An asset is anything a company owns which has a quantifiable value. This means that it can be turned into cash. Assets can further be broken down into current assets and non-current assets.

The assets that a company can convert to cash within a year are called current assets. Examples include cash equivalents, prepaid expenses, inventory, marketable securities, and accounts receivables.

Non-current assets are long-term investments that a company doesn’t expect to convert into cash in the short term. Examples include land, patents, equipment, intellectual property, etc.

The general order of accounts within current assets usually follows this sequence:

First, there are Cash and Cash Equivalents, which are the most liquid form of assets, including short-term investments like Treasury bills and certificates of deposit, as well as physical currency.

Next, there are Marketable Securities, which are debt or equity investments that have a readily accessible market for buying and selling.

Third, there are Accounts Receivable (AR), which represent money owed to the company by its customers. This category may also include a provision for customers who may default on their payments.

Fourth, there is Inventory, which refers to goods that are ready for sale, valued based on the lower of either their cost price or market value.

Finally, there are Prepaid Expenses, which are payments made in advance for services like insurance, advertising, or rent.

When it comes to long-term assets, there are three main categories to consider:

- Long-term Investments: These are securities that are intended to be held for a longer period of time and are not expected to be converted into cash within a year.

- Fixed Assets: Fixed assets refer to tangible assets such as real estate, heavy machinery, buildings, and equipment, that are typically capital-intensive and durable in nature.

- Intangible Assets: Intangible assets are non-physical assets, such as trademarks, patents, and goodwill, that hold value. They are often listed on the balance sheet only if they have been acquired and not developed in-house. The value of intangible assets can sometimes be difficult to determine and may be under or overstated on the balance sheet.

Liabilities

A liability is anything a company owes to anyone, including creditors and other parties. This includes payroll expenses, rent, utility, debt payments, money owed to suppliers, taxes, etc. Like assets, liabilities can also be classified as current liabilities and non-current liabilities.

Current liabilities are those liabilities that are to be paid off within a year. Examples include accounts payable and other accrued expenses.

Non-current liabilities are typically those that a company does not have to pay within a year. These are usually long-term obligations like leases, bonds, and loans.

Here are some common accounts that fall under current liabilities:

- Current Portion of Long-term Debt: This refers to the portion of long-term debt that is due within the next 12 months. For example, if a company has a 10-year loan for a warehouse, the portion that is due within the next 12 months would be considered a current liability, while the remaining 9 years would be considered a long-term liability.

- Interest Payable: This represents the accumulated interest owed, often due as part of a past-due obligation, such as late remittance on property taxes.

- Wages Payable: This refers to salaries, wages, and benefits owed to employees, often for the most recent pay period.

- Customer Prepayments: This refers to money received from a customer before the company has provided the service or delivered the product. The company has an obligation to either provide the good or service or return the customer’s money.

- Dividends Payable: This refers to dividends that have been authorized for payment but have not yet been issued.

- Earned and Unearned Premiums: Similar to customer prepayments, this refers to money received upfront by a company, which must return unearned cash if they fail to execute on its portion of an agreement.

- Accounts Payable: This is often the most common current liability, referring to debt obligations on invoices processed as part of the operation of a business, usually due within 30 days of receipt.

In addition to current liabilities, there are also long-term liabilities to consider, such as:

- Long-term Debt: This refers to any interest and principal owed on bonds issued.

- Pension Fund Liability: This refers to the money a company is required to pay into its employees’ retirement accounts.

- Deferred Tax Liability: This refers to the amount of taxes that have accrued but will not be paid for another year, often due to differences between requirements for financial reporting and the way taxes are assessed, such as depreciation calculations.

The Importance of Balance Sheets

The following are the main reasons why balance sheets are essential for businesses, irrespective of their size-

To Evaluate Risk and Return

A balance sheet lists the business’s assets and liabilities in one place. The current and long-term assets reflect the business’s ability to generate cash and sustain operations. Short and long-term debts prioritize outstanding financial obligations.

To Secure Loans and Investors

Balance sheets allow readers to quickly get an idea about the financial condition (including creditworthiness) of the business. While applying for loans, the balance sheet can help showcase the business’s ability to pay the money back.

Potential investors also use the balance sheet to understand how the funding will be used and when they can expect to see a return on their investment.

To Prevent Potential Problems

The primary goal of a business is to make a profit. A sound business should show increasing equity. If a business is unable to do this, looking at the assets and liabilities on the balance sheet can shed some light as to why.

It Makes Tax Preparation Easier

Keeping accurate business records is important for tax preparation and filing. When the business’s financial books are in order, the accountant will be able to accurately prepare returns and ensure that the business is not paying anything less or anything more than it should. The business owners will be able to present a complete set of financial records for inspection.

Importance of Balance Sheet for Business Owners

As we have pointed out earlier, the balance sheet reveals the business’s overall financial health because it reflects every transaction since it started.

Business owners can quickly know exactly how much money they’ve invested in the business and how much debt they have accumulated just with a single glance at the balance sheet. They can also make important business decisions like comparing current liabilities and current assets to make sure they will be able to meet upcoming payments.

The information contained in the balance sheet will aid in calculating critical financial ratios such as the Debt-to-Equity ratio and Current Ratio.

The current year’s balance sheet can be compared with the previous year’s balance sheet to see how the financial position of the business has changed over time.

Also Read:

Different Types of Accounts In Accounting For Businesses

What is GST? / GST Kya Hai?

Should a Balance Sheet Always Balance?

The assets side and liabilities side of the balance sheet should always balance out. The name itself comes from the fact that the business’s assets will equal its liabilities plus shareholder’s equity. The following are some of the reasons why a balance sheet may not be genuinely balancing:

- Incomplete or misplaced data

- Incorrectly entered transactions

- Error in currency exchange rates

- Errors in inventory

- Miscalculated equity calculations

- Miscalculated loan amortization and depreciation

Who Prepares the Balance Sheet?

Several individuals, including business owners and bookkeepers of the business, can prepare the balance sheet. Internal and external accountants can also prepare and maintain balance sheets.

Multiple copies of balance sheets should be kept at all times and updated regularly. Doing so will ensure that balance sheets have the same information and are free of discrepancies. Any such discrepancies can raise suspicion during audits.

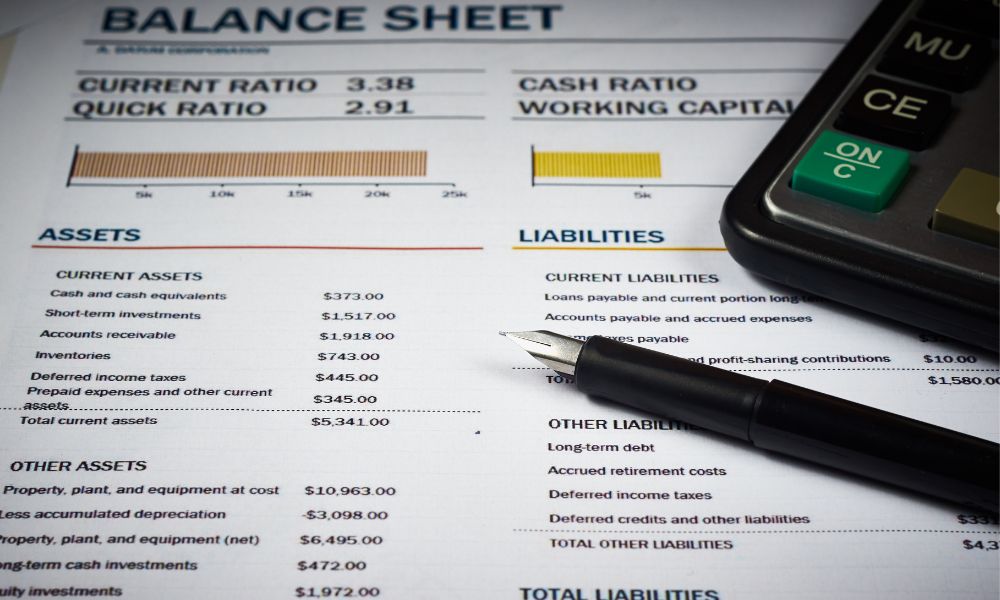

How to Analyze the Balance Sheet

The best way to analyze a balance sheet is by using financial ratio analysis. This method uses formulas to determine the financial health of the company. The same method can also be used to determine the operational efficiency of the business. There are two types of ratios that can be used:

- Financial Strength Ratios: These will tell the business owners how well they can meet their debt obligations. These ratios include debt-to-equity ratios and working capital ratios.

- Activity Ratios: These focus on current accounts and operating cycle expenses and can include receivables, inventory, and payables.

Accountants or anyone preparing the balance sheet can use any of the above-mentioned ratios with the information contained in the balance sheet to analyze a company’s financial strength deeply.

Format of Balance Sheet

There are numerous balance sheet formats available. Let us look at all of them in detail.

Vertical Balance Sheet Format

This is the most common balance sheet format in accounting. In this, there is a single column of numbers. It begins with assets, then liabilities, and ends with shareholder’s equity.

Items under each of these categories are listed in decreasing order of liquidity. For this reason, the items under assets mostly begin with cash and usually end with fixed assets or goodwill. Likewise, the liabilities section usually begins with accounts payable and usually ends with long-term debt.

The primary intent of the vertical balance sheet is for the reader to make comparisons between numbers on the balance sheet for a single period. For example, someone might want to compare the total of current assets to the total of current liabilities to estimate the business’s liquidity. Think of it as a comparative balance sheet format.

Given below is the format of the typical vertical balance sheet.

Common Size Balance Sheet Format

This is one of the two common size statements of a business, the other being the common size income statement. It is a balance sheet in which each item is calculated as the ratio of each asset in relation to total assets. For liabilities, each liability is calculated as the ratio of the total liabilities.

The common size balance sheet can be used for comparing companies that are different in terms of size of operation. Comparing such figures of different periods is not very useful because the total figures seem to be affected by numerous factors.

Standard values cannot be established for assets using this method because the trends of these figures cannot be studied and may not give proper results. It may lead to misleading numbers, especially for businesses that are impacted by seasonality. And since there is no approved benchmark, it is not helpful in high-stakes decision-making.

Given below is the usual format of the common-size balance sheet:

Provisional Balance sheet Format

Another popular balance sheet format a company, provisional balance sheets have the same information as any other balance sheet – assets, liabilities, and equity. The difference is that the information is temporary.

They are also referred to as unaudited balance sheets. Businesses use provisional balance sheets to prepare for financial audits. They ensure that there are no financial issues that need attention when businesses are required to report up-to-date data. Some scenarios include applying for loans and giving updates to investors.

A provisional balance sheet can be completed at any time during the year though they are usually made at the end of the accounting year. It includes assets, liabilities, and equity, with dates subject to revisions.

Here is the format of a provisional balance sheet (broken into two parts)-

Horizontal Balance sheet Format

Such a balance sheet uses more columns to present extra details about the assets, liabilities, and equity of a business. All account information is presented from left to right. All assets are shown on the equivalent side of all liabilities.

All liabilities are shown on the left side, and all assets are shown on the right side. Such a balance sheet has two sides. It includes only data from one financial year, thus making yearly comparisons difficult.

The format of the horizontal balance sheet is given below.

Projected Balance Sheet Format

Also known as pro forma balance sheets, a projected balance shows the estimated changes to a company’s financial status, including investments, other assets, liabilities, and financing for equity.

These projections are made by business owners or accounting professionals to understand more about the business and make projections about income and expenses for the future. The main items found on the projected balance sheet are assets, liabilities, and equity.

Projected balance sheets are necessary because they make strategic and practical planning possible. Before any long-term plans can be made for the business, it is crucial for them to understand the current growth trajectory of the business, including how assets will grow, what kind of dent the business can take on, and the equity it holds for shareholders.

Important decisions like hiring employees, securing investors, expanding operations, etc., can be made after the projected balance sheet is created.

The format of the projected balance is given below:

Balance Sheet Powered by Excel

Creating and maintaining financial statements, including balance sheets, was a painstaking process before the days of Excel. Now, Excel is saving countless hours by doing the heavy lifting while creating financial records.

Corresponding figures are automatically updated on one sheet when the linked sheet is updated. Excel also enables business owners to create visually appealing reports for making crucial business decisions.

But many business owners are unsure where to start nor do they know the balance sheet format in excel. They also don’t know how to manage it due to millions of data points present in multiple places. This is where templates from Lio can help as it lets you track your expenses, income, profits, losses, etc. all in one place, that too through easy-to-use templates. To access them, download the app now.

Do Balance Sheets Have Limitations?

A balance sheet only shows the financial metrics of the business at a single point in time. So, they are not very accurate in predicting the future financial performance of the business.

Balance sheets are also very static in nature. For the best financial analysis, accountants may have to draw on data from other financial statements in addition to the balance sheet. This includes statements of cash flow or dynamic income statements. These are better at indicating the financial health of the business.

The other drawback is that accounting systems or depreciation methods may allow business owners and managers to change things on the balance sheet. This makes balance sheets prone to corruption.

Some business owners may tamper with balance sheets to make the business look more profitable than they actually are. Therefore, it is essential for anyone reading the balance sheet to read the footnotes in detail to ensure there aren’t any red flags.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Lio can Help You?

Lio is a great platform that can help entrepreneurs, homemakers, students, businessmen, managers, shop owners and many others. This mobile application helps to organize business data and present them in an eye-catching manner.

Lio is a great platform for small business owners and can track a wholesome record of employee information for better employee management, customer data, etc. You can handle those data with ease.

If you want to be a professional, then you must save your time, you need to learn to arrange all the business strategies in one place. In that case, Lio can be your partner.

Entrepreneurs can also allow multiple authorized users of their office to access the information from various locations within minutes.

Lio is definitely for the win and using it for your business is only going to make your journey smooth and easy to track.

Step 1: Select the Language you want to work on. Lio on Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Maintaining a balance sheet is very important for businesses of all sizes. It aids in making decisions pertaining to the growth of the business, among other things. The company balance sheet format can either be created from scratch or, as mentioned above, downloaded as a template.

Frequently Asked Questions (FAQs)

Who uses the balance sheet?

The balance sheet is used by investors along with financial statements.

What are the types of balance sheet?

Report format and account form are the two types of balance sheets,

What is the balance sheet size?

A common-size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

What is balance ratio?

The balance-to-limit ratio is a comparison of the amount of credit being used to the total credit available to a borrower.