Why and How to Use a Profit and Loss Template to Track Business Performance?

Profit and Loss Template: What is it and how to use one to track business performance?

In business, almost all major decisions are greatly influenced by one element – Finance. Besides, how else can a business plan for an expansion? How will they know if there was a return on investment or the business is now running on profit?

Now imagine a scenario – a business goes ahead with an expansion plan or some other massive investment. And they are utterly oblivious to the fact that they are running on a loss. Chaos is imminent.

Situations like these highlight the need for a profit and loss statement. Also known as the income statement, or the statement of revenue and expenses, it is used to report a business’s financial performance over an accounting period. It supplements the balance sheet and cash flow statements.

In the earlier days, all records of accounting, including the profit and loss statement, were kept as hard copies – actual books. Fast forward to the modern-day business environment, where the once complex duties and responsibilities of the finance department have been greatly simplified by accounting software. Unfortunately, most of these accounting tools are either expensive or have a steep learning curve.

Luckily small businesses can be just as accurate with their financial statement (including the profit and loss statement) simply by harnessing the power of spreadsheets.

All they need is the right template. With such a template, businesses can get an accurate understanding of where they stand from a profit or loss standpoint. Now let us answer an important question.

Why Businesses should Track their Finances Accurately

- By monitoring the cash flow, businesses can establish cost control measures and see how they are spending and how much they are spending.

- Efficient tacking of expenses (preferably on a template) means that businesses can calculate their profits or losses without much effort.

- Regular review of expenses makes it easier to spot abnormalities and opportunities to save costs.

- Budgets are set based on how much money a business has, what the possible expenses will be etc. A profit and loss statement gives much-needed clarity to create budgets. It becomes easier to do so with a template because it is simple to link the profit and loss statement to other financial statements to arrive at a budget.

Format of a Profit and Loss Statement

The following are the main subheadings in a standard profit and loss statement:

- Revenue

- Cost of goods sold

- Gross profit

- Expenses

- Other income

- Taxes

- Net profit or net loss

Reasons to Use Profit and Loss Templates

The profit and loss template is a ready-to-use template that is modelled to work on any spreadsheet application, including MS Excel and Google sheets. Such a template helps businesses generate their income statements within minutes.

It also lets the business summarize and get an overview of its revenues, costs, and expenses for a specific period. Businesses usually prepare the profit and loss statement quarterly and yearly. If needed, even monthly reports can be generated.

Profit and loss templates give business owners the correct information at the right time. Getting this done is just as simple as plugging in revenue and costs to the template.

This will reveal the business’s profit by month, year, or a custom date range. It is also possible to see the year-on-year percentage change from the previous year.

With the right kind of training, anyone can quickly learn to use a profit and loss template – no degree in accounting is needed.

How the Template Calculates Profit or Loss?

A profit and loss template works using simple formulas that are embedded within the template to find the difference between the businesses’ revenue and expenses.

If the revenue or income for a particular period is more than the expenses, it is marked as Profit; if the business made more payments than the value of incoming revenues, it is marked as a Loss.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How to use Profit and Loss Templates?

Using the profit and loss template from Lio is a very straightforward process. Anyone with a fundamental level understanding of how business and finance works should be able to operate it with ease – that too with a few days of guidance and familiarity.

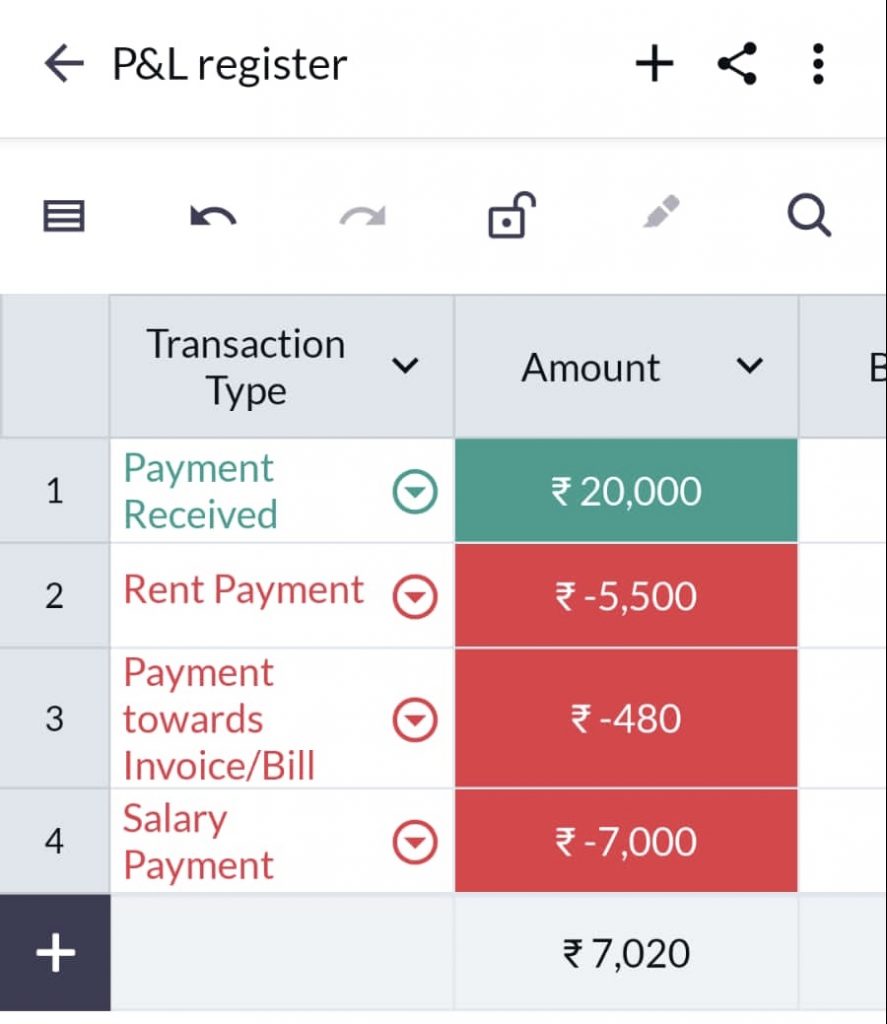

There are four standard headings in this template:

- Transaction type: To choose the type of transaction. Incoming payments are marked in green, while outgoing cash is marked in red. The available drop-down options include Payment Received, Payment towards Invoice/Bill, Advance Payment, Salary Payment, Rent Payment.

- Amount: To enter the amount received by or paid by the business for a particular transaction.

- Balance: Shows the balance of cash after adjusting for the transaction amount.

- Date: To enter the date of the transaction.

- Remark: To add any additional information pertaining to a transaction.

Here is a screenshot of the template:

Here are the steps to use this template to record a transaction

Step 1: Choose the transaction type. To enter any incoming payment, choose Payment Received. To enter any outgoing payments, choose Payment towards invoice/bill or any other options (as required) marked in red.

Step 2: Enter the value of the transaction in the Amount column.

Step 3: In the Date column, enter the correct date of the transaction.

That is it.

After every transaction is entered, the Balance Amount on the left top of the template will automatically update to show the cash balance. If the business has made more payments than the amount of income, the amount will be shown as a negative value. If it generated more revenue than expenses (the ideal situation), the amount will be a positive value.

Conclusion

Ask any business owner, and they will say that the P&L statement is one of the most important documents they prepare as it guides them in making significant business decisions. This is true for businesses of all sizes and not just large corporations.

Small and medium-sized businesses must keep a digital record of their financial statements, including the Profit and Loss statement from the get-go. This can be done without leaving a massive hole in their coffers by using the profit and loss template from Lio.

I hope you found this article useful and have learnt something about the profit and loss template.

6 Comments

Loved the idea of the drop-down option and the Color-coding feature.

Hello Sahil,

Thank you for the kind words.

I am glad that you liked the features of the profit and loss template. These features help in giving a quick recapitulation.

Do explore the template and share your experience with us!

So simple, yet effective. Will try out the templates today!

Hello Ashish,

Thank you so much for your kind words.

Do download the lio app and let us know in the comments.

Could you please give a brief explanation of the basic importance of cash flow and the requirement for analyzing it?

Hello Anupama,

Cash flow is a metric used to determine how much money a company earned or spent overall during a given period of time. On the statement of cash flows, cash flow is often segmented into cash flow from operating operations, investing activities, and financing activities. One of the most crucial procedures businesses may carry out to keep operations operating effectively is cash flow analysis.

Analyzing cash flow can help you determine how much money a company made or spent over a given accounting period. For your firm to be financially viable, you must be aware of your cash sources and where your money is going.