Top 7 Payment Gateways in India for E-Commerce

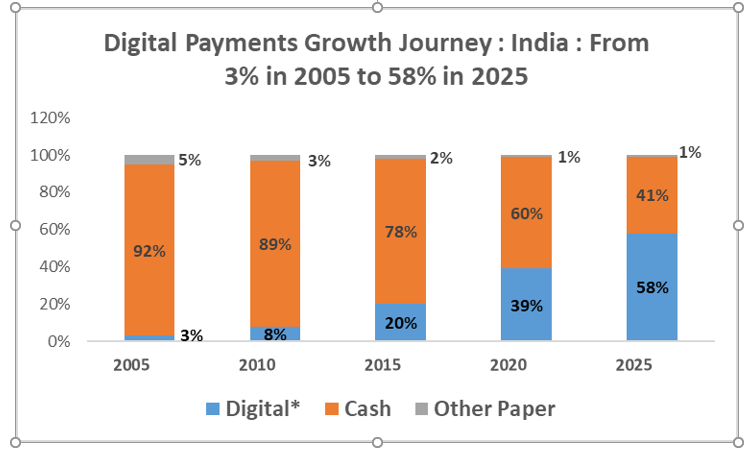

There was a time when all of us used to be scared of sharing our credit or debit card details online. But with the growing need of having things at our convenience, companies shift online and deliver utilities to our doorsteps. And that’s where you need Payment Gateways in India to make our life easier.

In today’s world, when everything is digital, especially after COVID has brought a new normal of maintaining a distance and staying at home, almost all businesses have switched to e-commerce. The ones who have not are facing many challenges and many of them have gotten shut because of almost zero customers.

Just switching to e-commerce is not enough. To fully function, businesses need to accept payments from customers digitally. Having good and secure payment gateways in India helps boost a business.

It makes the transactions easier, offering payments from online cash, debit or credit cards, and other digital wallets. Online payments have caught people’s fancy, directly affecting the increase in demand for safe and convenient shopping experiences.

When this trend was picking up, businesses were coming up with their own payment gateways but now that this industry is booming, today there are multiple payment gateways in India that let you make smooth, instant and safe payments done not just nationally but even internationally. Let’s look at the top 7 of the payment gateways companies you can choose for your own business.

Top 7 Payment Gateways in India for E-Commerce

Razorpay

Razorpay is one of the topmost payment gateways in India allowing companies to process, accept and disburse payments. Razorpay aims to make India digital stress-free.

They promote online payment in India by providing hassle-free integration to the people. It is used by merchants, online stores, and other companies to make online payments.

The speciality of the company is its easy integration and instant activation. The company has a huge clientele with all big, small and large companies using the product.

Not just this, Razorpay also attracts freelancers and self-employers who have loved Razorpay for being extremely simple. Some of the biggest clients of Razorpay are UrbanClap, Groffers, Unacademy, and BookMyShow.

On Razorpay one can accept all kinds of payments from various payment methods like net banking, UPI, wallets, credit and debit cards, etc.

Some of the top features of Razorpay are:

- 100 plus payment modes

- invoice payments

- easy integrations

- Dashboard facility to check real-time data

- Integration with the website

- API driven automation that requires zero manual intervention

- 24/7 support

Transaction Charge:

- 2% on Indian debit/credit card, net-banking, UPI

- 3% on Diners and Amex Cards, International cards, EMI

Cashfree

Cashfree is one of the leading banking expertise companies that supports transactions from MasterCard, Visa, Maestro, Rupay, American Express, and 70 Netbanking options. It is one of the cheapest payment gateways in India and offers a fast payment service and an instant refund facility.

Cashfree is the only payment application that lets you make bulk payments in India. It also supports UPI, NEFT, IMPS, and PayPal. One of the best features of Cashfree is “Cashgram” which produces a web link so that businesses can share the link to the users for payments.

Some of the top features of Cashfree are:

- Invoice generation

- Low transaction fee

- High security

- Website integration

- Auto collection of payment

- Instant fraud

- No setup cost

- Fraud checking

- Recurring billing facility

Transaction Charges:

- Net-banking, Debit and Credit card: 1.75% per transaction for 70+ banks

- International cards: 3.5% + 7 INR per transaction

- Pay Later and Cardless EMI: 2.5% per transaction

Also Read: Top eCommerce Business Ideas that you can consider today

instamojo

A digital payment gateway combined with an e-commerce platform for Indian merchants, Instamojo provides collecting payments through Visa, Diners, Master, AMEX, JCB, Discover, wallet, and UPI.

One of the most exciting things about this platform is that they allow their customers to register with them, even if they do not have their own website.

It is one of the most successful payment gateways in India that has more than 1 million active users and this is because of its very simple and easy user interface.

Instamojo allows recurring billing facilities for businesses to accept payments on a monthly basis. It also takes no charges for NEFT/RTGS and bank transfers.

Some of the top features of Instamojo are:

- Website and app integration

- Easy onboarding process

- Payment analytics

- Electronic invoice payment

- Live chat support

- 100+ payment modes

- Recurring payment

Transaction charges:

- NEFT/RTGS/Bank Transfer: FREE

- Debit and Credit cards: 2% + 3 INR per transaction

- International credit cards: Available on request

- Digital products and files: 2% + 3 INR per transaction

about this platform is that they allow their customers to register with them, even if they do not have their own website.

PayU

Also known as PayU money, the payment gateway focuses on merchant shopping and payments and provides a single integration solution to receive other payments. This is a Netherland-based fintech company offering payment technologies to merchants.

PayU offers minimum payments efforts, making it one of the most widely used payment gateways serving 4000+ merchants. PayU is one of the most popular payment gateways in India due to its amazing features and offerings to its customers.

With more than 100 payment methods like net banking, cards, wallets, EMI, UPI, and buy now pay later, PayU definitely is one of the top used payment gateways.

It allows its customers to make changes and customize their checkout page. The company operates in about 17 countries with leading clients like Netflix, Airbnb, Ola and Dream11.

Some of the top features of PayU are:

- Multiple currency processing

- International payments

- Invoice generation

- Facility for recurring bill

- Website and mobile integration

- Dedicated account manager

- 100+ foreign currency

Transaction Charges:

- 2% + GST per transaction

Also Read: Difference Between eCommerce and eBusiness

paytm

Paytm is definitely one of India’s most popular and widely used payment gateways and is mainly a hit among small business ideas and small business owners. It would be safe to say that Paytm is the synonym of digital payment in India, at least.

Paytm is easy to use with a massive consumer base and has made the transactions convenient and straightforward, offering multiple modes like cards and Paytm wallet.

It supports all major payment sources including both international and national cards, UPI, Paytm Wallet, Paytm postpaid, and net banking. It is the only payment gateway in India allowing a 0% transaction fee of UPI payments and the only payment gateway that has a T+1 settlement schedule.

If you are a Magento store owner, you can check the method to integrate payment with Magento. Some of the brands that use Paytm are Uber, Swiggy, Jio, Zomato and more.

Some of the top features of Paytm are:

- 100+ payment sources

- Dedicated support

- Instant activation

- Industry best success rate

- Easy Integration

- Paytm Mall

Transaction Charges:

Paytm offers various pricing plans but as Meetanshi’s blog reader or customer, you can avail the below pricing plan:

- UPI : 0%

- Netbanking: 1.80% + GST

- Paytm Wallet: 1.55% + GST

- Credit Card: : 1.85% + GST

- Debit Card: 0.4% + GST for amount < 2000, 0.9% + GST for amount > 2000

- Debit Card (RuPay): 0%

- AMEX/International: 2.65%*

Gpay

Also known as Google Pay, it is another one of the popular payment gateways in India that is common among Indians. Offering rewards for every transaction, Gpay allows users to use smartphones, tablets and watches to make all sorts of payments.

This digital wallet platform is very popular among small-scale Indian merchants. Business owners can use instant payments from their customers by sharing contact details or QR codes with Gray.

Some of the top features of Google pay are:

- Instant transaction

- Available in multiple Indian languages

- Instant money transactions from the bank account

- Multi-layered security

- Offers multiple payment options

Transaction Charges:

- 2.9% fee is charged when you use a credit card for transactions.

- No charges are applied to the transfer of money to family or friends, or when you use a debit card to make a purchase in a store or through a service.

BHIM UPI

Bharat Interface for Money is a well-known payment application in India that lets users make all kinds of payment transactions hassle-free while using Unified Payment Interface (UPI). With BHIM UPI, you can make bank-to-bank payments and make money from your mobile phone or virtual payment address, also known as UPI ID.

With online payment gateways, it has become easier and very convenient for buyers to shop. Businesses are flourishing again as the transactions have become digital, and the demand has increased. This securely conducted mode of online transaction is sure to make your business transactions effortless.

Some of the top features of BHIM UPI are:

- Scan & pay

- Payment through bank account

- Request money feature

- Check transaction history

Transaction Charges:

- Varies from bank to bank

With online payment gateways, it has become easier and very convenient for buyers to shop. Businesses are flourishing again as the transactions have become digital, and the demand has increased. This securely conducted mode of online transaction is sure to make your business transactions effortless.

6 Comments

Very well researched. Amazing write-up!

Hello Sukhman,

I appreciate your warm words.

I’m glad you found this article to be interesting.

Do you know the person who invented the first payment gateway? This is the first question that popped into my head when I read this post.

Hello Liara,

The Payment Gateway was developed by Jeff Knowles. There weren’t many trustworthy solutions on the market prior to 1996. Then Jeff Knowles introduced his concept for a payment gateway, forever altering the way payment gateways work.

After reading this article, I no longer have any concerns about using any of the payment gateways that are described here, despite my previous concerns. I appreciate your explanation and the rich insights you included in your article.

Hello Madan,

Thank you so much for your kind remarks.

I’m so grateful that this article helped you resolve your confusion.