What Can a Business Do to Improve Cash Flow?

Let’s begin with an alarming fact – 82% of the time, lack of understanding or poor cash flow management contributes to businesses failure and that’s why we came up with the tips from which your business can improve cash flow.

The reason is simple – if you have issues in cash flow, then you may not have the funds to pay your suppliers. And when that happens, your business relationships take a toll, damaging your overall reputation and leading to closure.

But what exactly is cash flow?

“Cash flow” refers to how cash moves in and out of your business’ bank account.

Cash inflows are your income, and cash outflows are your expenses. No matter what the industry, size or the business’s growth trajectory, if the cash outflows exceed cash inflows for a long period, then the business is not healthy.

Tips To Improve Cash Flow

To help prevent such a situation, here are some handy tips curated for you by the Lio team –

Take action and collect your receivables

Developing standard procedures to collect accounts receivable (amounts owed to your business), typically from customers who pay on credit, is the most important step to improve cash flow.

The standard practice in most businesses is to wait until the invoice is ‘30 days past due’ to call the customer. This can be tweaked a bit.

Call the customer a little earlier, say when the account receivable is 25 days old. Offering small discounts on early payments of receivables may also encourage your clients to pay sooner.

Get a credit card

A credit card has always been a boon for most people (and businesses, of course). Businesses can use it to purchase materials and pay for them later, which obviously has a positive impact on the cash reserves as you have the flexibility to pay when you have better cash inflows.

Moreover, by using a credit card, business owners have a detailed record of finances and a paper trail of money coming and leaving their accounts every month.

Improve sales and send invoices at once

One of the top tips to improve cash flow. The more the sales, the better the cash flow. A business owner must continuously strategize with the sales team to quickly move products from the shelves into their customer’s hands.

It is also important to send the invoices immediately with a due date to pay for the purchased products.

You can switch to a modern cloud-based system of invoicing if your current process of invoicing is tedious and time-consuming so it speeds up your process of invoicing and improve cash flow.

Increase leasing of large equipment and/or real estate

Purchasing large pieces of equipment or any other assets required for business operations can negatively impact cash flows, resulting in a hefty outflow of cash to settle the bills.

If you don’t have the money to buy the equipment outright or your business does not qualify for a working capital loan, it might be worth considering leasing equipment.

This way, a company can acquire the latest technology without emptying its coffers. In other words, it will keep the cash flow in check.

Getting rid of outdated or excess equipment

Whether it’s obsolete printers, old desktop computers, or even an outdated inventory, you have to identify and sell them.

Use the received cash for your operational expenses or to purchase new materials. A big sale on stock can also turn into a quick profit for your business while reducing inventory at the same time.

Offer discounts

Giving a huge discount can encourage customers to purchase things that they might not otherwise have, resulting in greater revenue and improved cash on hand.

Pro tip – Adopt bundled discounts wherever possible. For example, when you buy X along with Y, you get a Z% discount. Such deals can increase your average transaction value, thus boosting the revenue and cash inflows.

Gain insight by cash flow forecasting

Cash flow forecasting is a proactive way of determining the upcoming highs and lows in cash flows and preparing the business for any future financial turmoil.

This forecast is typically for the next 30 or 90 days. Such projections analyze operating cash, revenues, and payments to help identify shortfalls before they happen. For longer-term forecasting, create an annual cash flow projection for two or three years.

Reduce overheads

Take a careful look at your cash flow statement and distribute your company’s expenses into two buckets – unnecessary and necessary. Completely cut down on unnecessary costs and try to minimize the essential costs as much as you can. For necessary expenses, find if there is a cheaper alternative.

Pro tip: Check whether you get the best deals on insurance, phone, and technology services. Pick a plan that is lower than the present one without compromising on your needs.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

Using Lio to improve Cash Flow

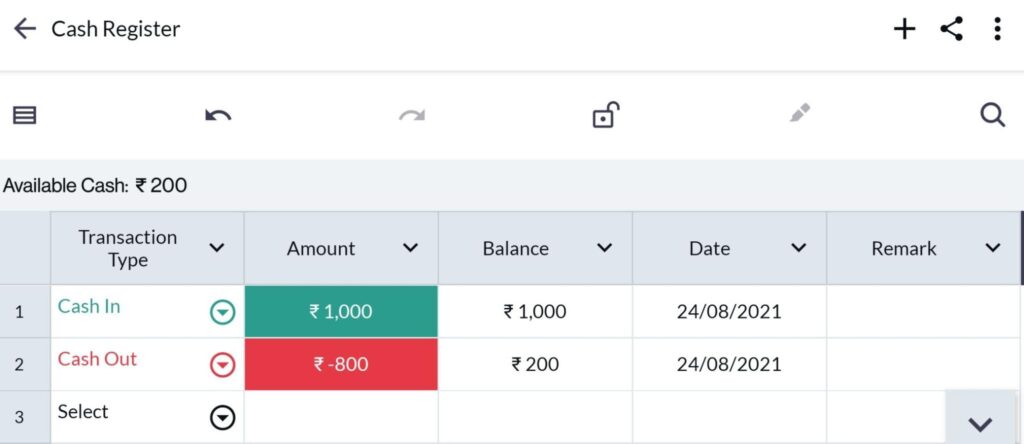

The Lio App empowers small business owners to create and manage their cash flow right within their smartphones. Track cash on hand by developing a detailed breakdown of how much you have paid and received in a particular time frame.

This can be done using the ‘Cash Register template’ in the Lio app. Access this template by navigating to Small Businesses > Cash Register.

Once you are inside the template, decide the transaction type for every record – Choose whether it is ‘Cash in’ or ‘Cash out.’ Apart from showing the total available cash in hand, it will also show you the balance cash in hand after every transaction.

Step 1: Select the Language you want to work on. Lio for Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Wrapping Up

Business owners running an enterprise without tracking or forecasting cash flows is comparable to a driver who only watches the speedometer and does not check the fuel indicator.

All that they care about is how fast they are running without planning for the future. Adequate cash flow planning is essential for a business to survive and thrive in this competitive business world.

“Revenue is vanity, profit is sanity, but cash is king.”

6 Comments

Don’t you think with the use of credit cards, the possibility of overspending is more?

Hello Rakesh,

thankyou for the question.

Research confirms that people do spend more money when they make a credit card purchase compared to using cash.

Despite this, many advantages come along with using credit cards, such as the EMI facility, easy access to the credit facility, and security. Using credit cards helps in increasing one’s purchasing power and avoiding foreign transaction fees.

Always try to practice responsible credit card shopping. You can also earn significant rewards, helping in building credit.

Here are a few tips to help you practice a responsive style of credit card spending.

Avoid impulse purchases; don’t let rewards tempt you. A credit card records each purchase made through the card with a detailed list sent with your monthly credit card statement. With the help of this, you can always track your spending.

What happens if I have a poor cash flow, kindly explain in a nutshell?

Hello Sandeep,

When the incoming cash flow is insufficient to cover the needs of your company’s outgoing cash flow, you have poor cash flow. Normal operations, upcoming investments, and your company’s overall growth goals are all slowed down by poor cash flow.

Due to poor management and forecasting of cash flows, your company could also encounter cash flow problems. Cash flow problems prevent your company from earning enough money to pay its debts and settle its invoices.

Thank you for the well-written, precise post. I can confidently state that this post has helped me with my business. Please, if you can, give me some advice on how to manage my employees.

Hello Nyla,

I really appreciate your warm remarks.

I’m delighted that this article enhanced your business.

There are numerous effective tips for managing employees. Effective personnel management is a key component of running a small business successfully.

You may establish a practical and effective workplace with effective personnel management.

Your firm will prosper if you have productive, diligent staff, but it could crumble from the inside out if you have disgruntled, complacent workers.