Learn How To Calculate GST On Your Own

Are you a newly registered business under GST and seeking assistance on how to calculate it? This article provides you with relevant information.

Before we jump on how to calculate GST, we will first have to know about what is GST.

Steps To Calculate GST

Many people find it confusing how GST can be appropriately calculated. The below-mentioned steps can be very helpful:

Find the Rate of GST that will be Levied on the Goods

The first step is to know which GST slab will be applicable to the goods and services. For this, the registered person has to;

- Know HSN code or SAC code- If the business is dealing in supply of goods then it is mandatory for it to know what its “Harmonized System of Nomenclature” or HSN code is because this international system helps in classifying all types of goods that are internationally transacted. And if the business offers services it has to find its “Service Accounting Codes” (SAC)code that is used for all the services under GST.

- Find the GST Rate that would be Levied- After knowing what the HSN code or SAC code is the next step is to know which tax slab will be applicable on the goods and services. The GST has been differentiated into four tax slabs, that is, 5%, 12%, 18%, 28%.

Determine the component of GST applicable

After checking the rate slab of the goods and services and knowing in which category your business falls, the second step is to know the component of the GST applicable. There are three components in which GST is divided, CGST SGST and IGST.

- CGST and SGST are applied to the intra-state transaction of goods and services. Intra-state transaction means when the goods or services are supplied within the state whereas IGST is applied when the transaction is done inter-state that is between two states.

- The GST levied when the transaction is intra-state is divided between both CGST and SGST while IGST is levied as a whole.

Know if Reverse Charges are Involved

Reverse charges mean that the recipient or the person receiving goods and services will be liable to pay the tax instead of the supplier. Usually, under GST the supplier has to pay it but while calculating GST the person should know if the reverse charge mechanism is followed in the transaction or not.

Enrolment in GST Composition Scheme

The GST composition scheme means that the supplier opting will not be able to claim input tax credits, and can not do inter-state transactions. The reverse charge service rates have to be paid.

Many suppliers find compliance with GST difficult, so they enroll in a composition scheme that helps in aggregation of the amount but only the businesses having a turnover of fewer than ₹75 lakhs can enroll in this scheme.

The supplier has to provide proper documents that recognize him or her as a composition supplier. Before the calculation, it is important to check if the supplier has enrolled in such a scheme.

Transaction Type

The type of transaction is also a factor affecting the calculation of GST. The types include; business to a business transaction or business customer transaction where the supply of goods is less than ₹2.5 lakhs or is it business to customer transaction where the supply of goods is more than ₹2.5 lakhs.

The supply of the goods and services is only termed as business to business (B2B) transaction when both the parties involved, receiver and supplier, are registered under GST and have a GSTIN.

When a transaction takes place under the B2B type, the recipient is not liable to receive any input tax credit or provide any details of the GSTIN but when the transaction is worth more than ₹2.5 lakhs then information like name, address to know the supply place.

Different types of GST slab

5% GST Rate

GOODS under this rate about 14% of items fall which are usually less than ₹1000, packaged food items, cream, paneer, frozen vegetables, coffee, tea, spices, pizza bread, rusk, cashew nut, raisin, ice, Kerosene, Coal, Medicine, Agarbatti, Postage Stamps, Fertilizers. SERVICES- transportation by railways, cabs and taxis, tour services, restaurants with turnover of ₹50 lakhs, rail and economy class air tickets, hotels with stay rate less than ₹7500, etc.

12% GST Rate

Around 17% of the goods are there in this tax slab. GOODS like butter, cheese, ghee, dry fruits in packaged form, animal fat, sausages, fruit juices, namkeen, ketchup & sauces, ayurvedic medicines, all diagnostic kits and reagents, cellphones, spoons, forks, tooth powder, umbrella, sewing machine, spectacles, indoor games like playing cards, chess board, carrom board, ludo and many others. SERVICES like hotels, guest houses, business class tickets, movie tickets less than ₹100, etc.

18% GST Rate

Around 43% of goods and services are categorized under this slab. GOODS like Mineral water, Pasta, Pastries, Soups, Preserved vegetables, Cocoa butter, Chocolate, Plastic tarpaulin, Aluminium foil, Optical fibre, Coaxial cables, perfumes, paints, pumps’ parts, tyre tubes, cosmetic products, shampoo, mattress, stationery products etc come under the item list. SERVICES- movie tickets of more than ₹100, telecom services, IT services, circus, theatre, hotels that take ₹7500 and above per night for stay, etc

28% GST Rate

200 products are there in this category. GOODS- Aerated water, Chocolates (without cocoa), Custard powder, Sugar syrups, ATM vending machine, Air conditioners, Dishwashers, Eyelashes, Wigs, TV monitors over 32 inches, Caffeinated beverages, etc. SERVICES like 5-star hotels, casinos, entertainment services, etc fall under this category.

Example Of GST Calculation

Here is an example of how tax amount is calculated under the GST system:

We have assumed that the product sold comes under the 12% GST slab,

Value to Manufacturer

Cost of production= ₹300,000

10% profit margin= ₹ 30,000

—————————————————————–

Total cost of production= ₹3,30,000

6% SGST= ₹ 19,800

6% CGST= ₹ 19,800

—————————————————————–

Manufacturer’s Invoice value= ₹3,69,600

—————————————————————–

Value to Wholesaler

Good’s cost= ₹3,69,600

10% profit margin= ₹ 36,960

——————————————————————

Total Value to wholesaler= ₹4,06,560.0

6% SGST= ₹ 24,393.6

6% CGST= ₹ 24,393.6

——————————————————————-

Wholesaler’s invoice value= ₹4,55,347.2

——————————————————————-

Value to Retailer

Cost of goods= ₹4,55,347.2

10% profit margin= ₹ 45,534.72

——————————————————————-

Total value to retailer= ₹500,881.92

6% SGST= ₹ 30,052.9152

6% CGST= ₹ 30,052.9152

——————————————————————-

Retailer’s invoice value= ₹5,60,987.7504

——————————————————————-

The tax is levied on every process the goods have been gone through while sales.

How To Calculate GST Using Online Calculator?

There are several websites on which GST can be calculated online. To use online GST calculator, follow these steps:

- Select the inclusive or exclusive type of GST.

- After this enter the product’s amount.

- Select the rate of GST applicable.

- The last step is to click on the calculate option given on the website.

- The amount will be calculated without doing much.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How Lio Can Help?

Lio is made to make your businesses savvy by providing a place where you can keep all your data safe and secured. You can make folders, add images, make templates, make lists, collect transaction-related data in place without any hassle.

The data is accessible for you whenever you need it. You can store GST-related documents and categorize them in one folder, you can make sheets and templates. All in all, Lio is a mobile integrated app that helps anybody to store their data and optimize it as they like.

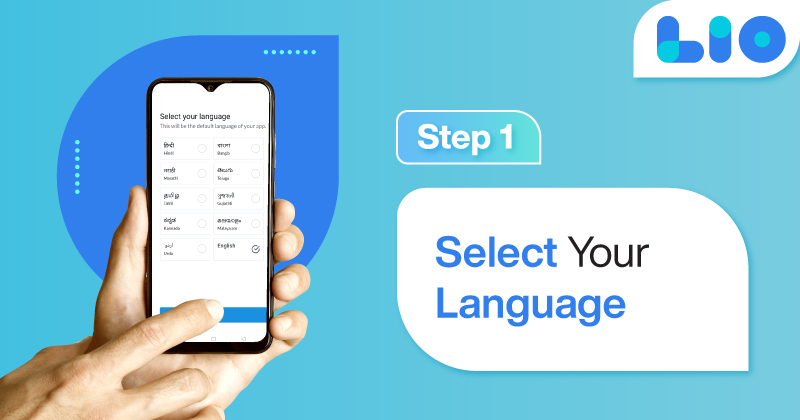

Not downloaded the Lio App yet? Here is how you can start with Lio App.

Step 1: Select the Language you want to work on. Lio for Android

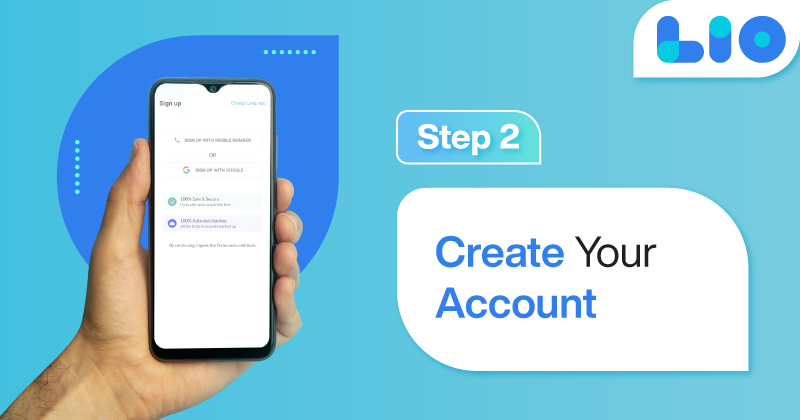

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Goods and Services Tax is mandatorily applied on the businesses that justify all the provisions of the Act. The tax is levied in four tax rate slabs.

Understanding the term GST can b really hard for some businessmen who first register themselves as a taxable person under the tax.

Moreover, the calculation is also very fussy for some. In the above article, we have provided some important pieces of information so that it is easily understandable for everyone to understand. Follow the steps to calculate the GST.

Frequently Asked Questions (FAQs)

Who has to register under GST?

The businesses with turnover above ₹40 lakhs and the businesses with a turnover above ₹20 lakhs established in northeastern and hilly states have to register under GST.

What is the rate of taxes in GST currently?

The tax rate is applied in four types of slabs- 5%, 12%, 18%, 28%.

Are there any areas of the country exempted from GST?

No, there is no area-based exemption under this tax but some of the goods are exempted from it.

Can a person voluntarily register under GST?

Yes, a person can register voluntarily even if he is not liable as per section 25 (3). He will be treated as a taxable person and all the provisions should be applicable to him.

Do only services come under reverse charge?

No, as the guidelines of GST suggest both goods and services are included in the reverse charge mechanism.

How is a taxable event defined in GST?

A taxable event means the supply of goods and services that can be intrastate or interstate.

How to get your GSTIN?

You will receive your GSTIN when you have successfully done these steps:

– Generated your GST application Form

– Filled in all the details

– Registered for Digital Signature Certificate (DSC)

– Verified and submitted the form

– After your application gets approved you will receive a message and an

– Email with your GSTIN in it.

Is using an online GST calculator beneficial?

Yes, an online GST calculator can be used to save time and also it helps in calculating an accurate amount of tax.

10 Comments

You’ve done an excellent job of explaining the various types of GST slabs. Thank you very much for providing us with such essential information.

Hello Yoshita,

Thank you so much for your warm words.

I’m very pleased this article was enlightening for you.

I appreciate you sharing all of these useful information.

Could you please explain the importance of a profit and loss statement in a business?

Hello Hameed,

Thank you for your kind words.

A profit and loss statement, also known as an income statement, displays your company’s profitability over a given time period. P&L statements are crucial since many businesses are compelled to prepare them by law or as part of their membership in an organization. The management team of a corporation, including the board of directors, can better comprehend the net income of the company by using a P&L statement, which may aid in decision-making.

You can track your business activity using profit and loss statements. Although it can cover any time frame, it is typically created on a monthly, quarterly, or annual basis.

I had no idea there were GST calculations available online. It’s all because of you that I’m reading your articles and learning so much. Continue to write more on relevant subjects.

Hello Raji,

I truly appreciate your warm words.

That this essay was enlightening for you makes me happy to know.

Yes, I will certainly write more on relevant subjects.

I used to believe that calculating GST was extremely tough until I read this article. Thank you for providing me with all of this information.

Hello Oormila,

Thank you for your kind words.

I am delighted that you found this article instructive.

Happy reading!

I recently changed my email address. Can we add this new email to our GST portal??

Hello Davian,

Yes, you can change your email address in the GST portal. This option can be found under the Registration Tab.