8 Easy Steps On How To Create an Effective SMB Budget

If Finance is the blood of the business, then budgeting regulates how much and where the blood goes.

A little more on one side or a little less on the other can tamper with the smooth functioning of the business and that’s when an effective SMB budget works.

For example, you could better invest money in marketing to gain new customers than setting up a new branch. Budgeting can help small businesses identify available capital, estimate spending, and predict revenue by planning their business activities.

Through this article, we will take you through the different kinds of expenses you are likely to deal with as a small business owner and how to create a fool-proof budget. But first, let us answer a very simple but important question –

What is a Budget?

A budget can be defined as –

“It is a detailed plan outlining where your business’s money will be spent over a specific period.”

Your money is allocated towards different business functions based on what you think is best. This enables you to compare the actuals with the plan to see how well you have performed.

Different Kinds of Small Business Expenses

Expenses for small businesses can be split across two broad headings – Capital Expenses, Business Expenses/Operating Expenses. Let’s look at what they are.

Capital Expenses

They are those needed for upgrading, acquiring, and maintaining the assets of your business. It is incurred primarily while undertaking new projects or making new investments. Some of the most common capital expenses are:

- Location costs

- Furniture, equipment, and machinery

- Intangible assets such as trademarks, patents, copyrights, etc.

Business Expenses

They are those incurred for the day-to-day operations of the business. Small business owners should try to reduce operating costs without it impacting everyday activities negatively. The following are the most common business expenses:

- Commercial property rent

- Inventory costs and business utilities

- Marketing costs

- Taxes

- Traveling costs

Steps to Create an SMB Budget

Creating an SMB budget requires careful evaluation of multiple factors that cost money. You should also identify aspects of the business you would like to improve. This lets you set short-term and long-term goals for your business. The following are the steps you need to follow to create a budget –

Step 1: Analyze Costs

Before creating an SMB budget, you need to analyze your operating costs deeply. If you create a budget and later find out that you need more money for operations, you will not achieve your goals quickly. Your SMB budget should be such that it adapts to circumstances when the business starts growing and expenses increase.

All kinds of costs, including fixed, variable, one-time, and unexpected costs, should be considered. It is acceptable to overestimate costs as you will need enough money to handle future expenses. This level of careful planning will keep away any surprise expenses.

Step 2: Negotiate Costs with Suppliers

You need to do this, especially if you’ve been in business for over a year and are dependent on suppliers. Before setting your yearly or quarterly budgets, talk to your suppliers and see if they can give you a discount.

Such negotiations will also help you create a trustworthy relationship with suppliers and come in handy when cash is running low.

For example, if yours is a seasonal business, you can make advance payments to suppliers as compensation for the period when you were unable to make payments.

Step 3: Estimate Revenue

Thousands of businesses have failed because they overestimated revenue and borrowed money for operational expenses.

To avoid this, it is recommended to analyze previous revenue (monthly, quarterly, and annually). They can act as reference points for the upcoming period to set your SMB budget realistically.

Step 4: Know your Gross Profit Margin

The money you are left with at the end of the year after paying all your expenses is called gross profit margin.

Preparing profit and loss statements correctly gives a great insight into the financial health of your business. For example, at the end of the year, if you still have debts to be paid even after bringing in good revenue, it indicates poor financing standing.

Identify the costs that are not adding value to the business and try to eliminate them as early as possible. The ideal way to do this is to deduct the cost of goods sold from the overall sales revenue.

Step 5: Project Cash Flow

To improve the cash flow of your business, you should balance customer payments and vendor payments.

Make payments easy for customers by creating flexible payments terms and accepting payments through the most popular payments channels, including digital.

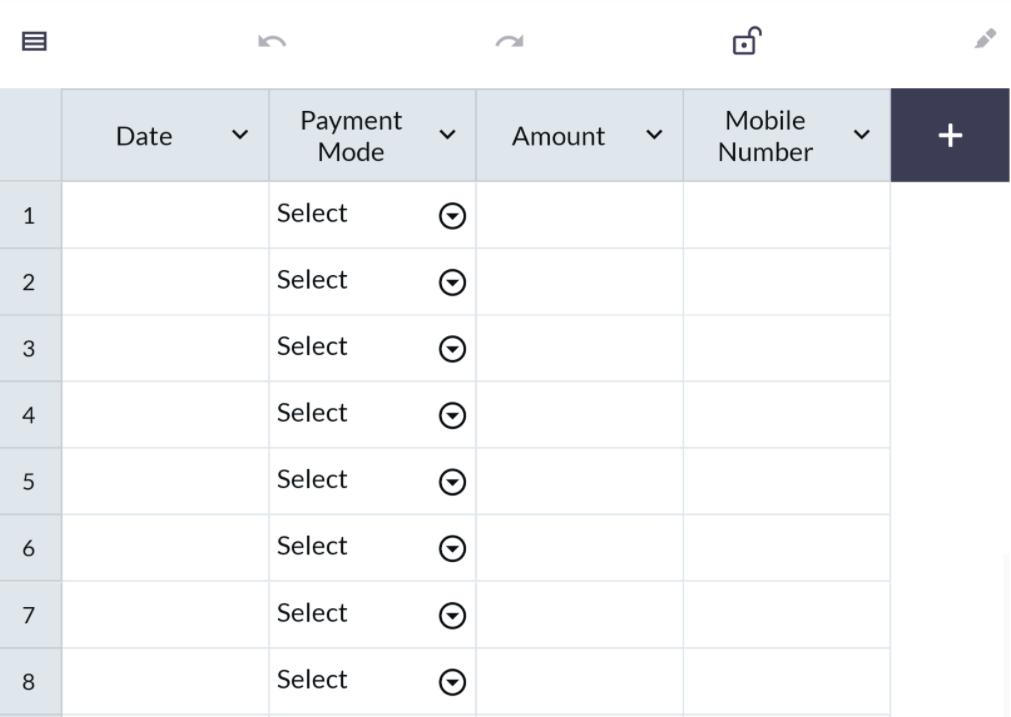

Encourage payments by giving customers a grace period and also enforcing policies for defaulters. You can keep a close eye on payments using Lio’s “Payment Received” template. Given below is an outline of it:

You might also want to keep aside some money for “bad debt,” in case customers never pay you. If you know an estimate of how much money will be incoming, you can fix an amount for salaries and other expenses.

Step 6: Consider Seasonal and Industry Trends

There will be periods during which your business will be booming, and there will be times when sales are low.

Due to this industry uncertainty and seasonality, you have to keep cash aside and spend effectively so that the business isn’t put at risk of shutting down during the off-season.

To overcome this challenge during budgeting, gather insights as to when the business performs at its best. The goal should be to earn as much as possible to stay afloat during the off-season.

Step 7: Set Spending Goals

Budgeting is more than just finding the difference between your revenue and expenses. The success of your business is also dependent on how cleverly you spend your money. Setting goals for your expenses make sure money goes only to where it is supposed to go to.

For example, imagine you are spending too much on expensive and unnecessary high-speed internet plans. In that case, it may be time to redirect it for other operational expenses.

Also Read: How to Open a General store And general store items you must keep

Step 8: Assemble Everything

Once all the necessary information has been collected from the previous steps, it is time to create your budget.

You will get an idea of the amount you have to create your SMB budget once you find the difference between your income and costs (fixed and variable). Be ready to tackle any unexpected one-time expenses that may pop up.

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

Conclusion

If you have read this far, you will know by now that an SMB Budget is absolutely necessary for financial success and, in effect, the overall success of a small business. Setting a budget for your finances is like putting a leash on an overexcited dog, without which your risk the possibility of losing it.

6 Comments

Useful post. Thank you for enlighting us with the steps on how to create an effective Smb Budget.

Hello Piyush,

I’m grateful for your warm words.

I’m delighted this article was interesting to you.

Would you kindly provide me with an expense ratio that is suitable for a small business?

Hello Anil,

Annual fund operating expenses, also known as the expense ratio, are the percentage of assets owed to the fund management (i.e. AMC) as the maintenance charge. Your business will do well with a 2 to 1 ratio. You now have two times as many assets as obligations.

What an excellent article. The many sorts of budgets, how to build budgets, and other topics were all thoroughly described by you. Thank you so much. Do continue to write about relevant subjects.

Hello Joshua,

Thank you so much for your warm words.

I’m delighted this article piqued your curiosity.

Yes, I will absolutely write more articles.