All About Sales Entry In Tally

It is essential for businesses to obey the GST rules, and Tally.ERP9 is software that helps them be so. Here is everything about sales entry in Tally.

Tally ERP 9 is India’s other very popularly adopted accounting system (ERP stands for Enterprise Resource Planning).

It’s a full-featured management software for small and medium-sized businesses. It’s a remarkable organization and GST software application that integrates control, functionality, and customization.

Tally. ERP 9 is a software suite that includes finance, accounting, inventory, point of sale, sales and purchase, manufacturing, payroll, costing, and branch management, as well as TDS, TCS, Excise, and GST compliance features. This article particularly elaborates on sales entries in Tally.

What is a Voucher in Tally?

A voucher is a form of documentation produced by an organization’s or business’s accounting department. Vouchers are used to collect and organize data in the format of receipts, purchase orders, certificates, and other details needed to complete a transaction.

In Tally, a voucher is a document that contains all of the information of a business transaction and is used to register it in the accounting books. They are simple to make and modify.

Accounting Vouchers

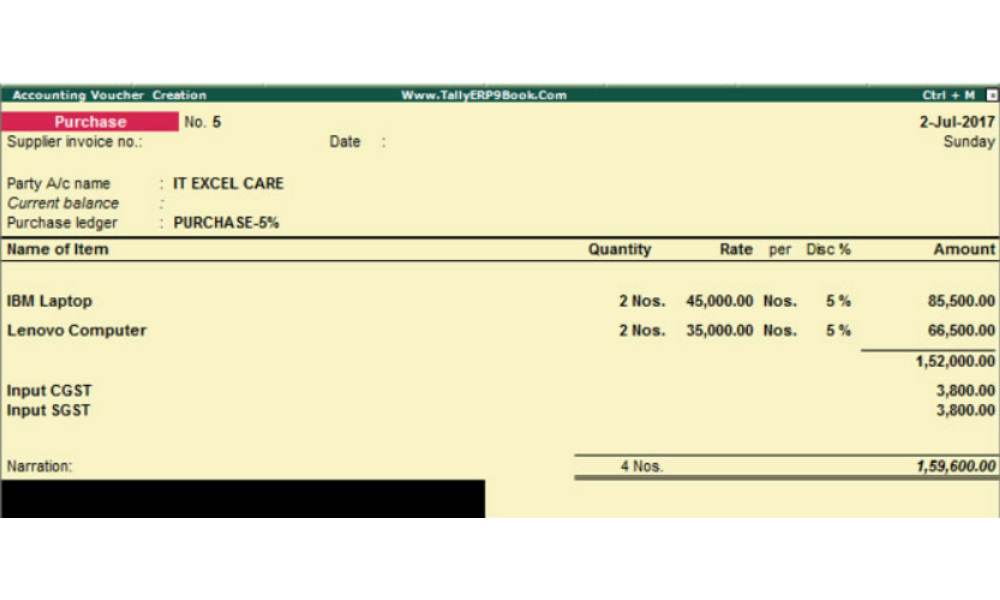

Purchase Voucher

Purchase vouchers, similar to sales vouchers, are classified as accounting documents and come in both invoice and voucher types.

Tally makes it simple for bookkeepers to amend and update receipt information since it uses a voucher format. Tally also facilitates the conversion of an invoice-format purchase voucher to a voucher-format purchase voucher.

Payment Voucher

Yet another accounting voucher in Tally is the payment voucher, which is used to write and print cheques against an order. After the payment voucher has been approved, go to ‘banking’ and then ‘cheque printing’ to print the appropriate check.

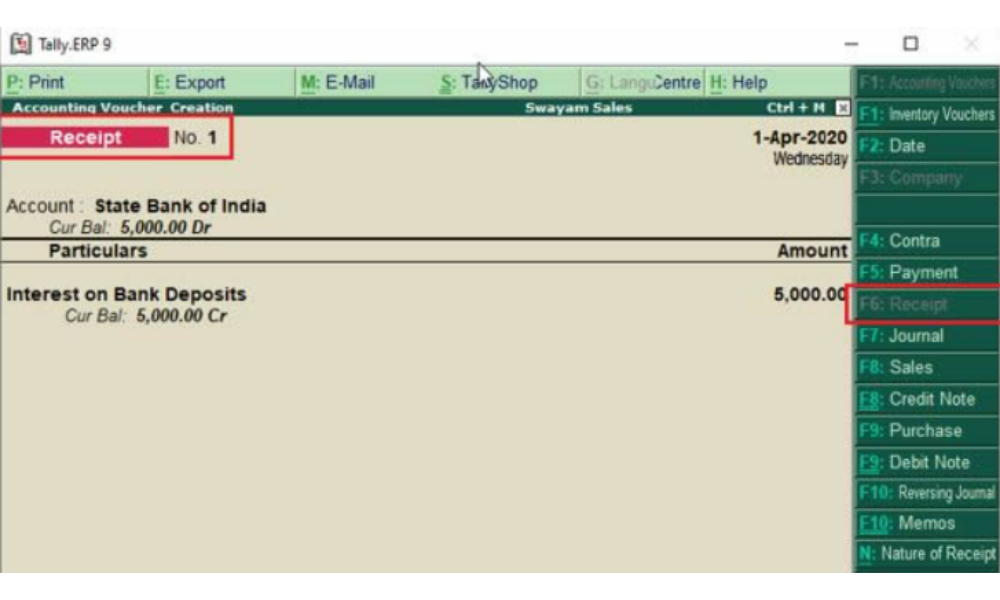

Receipt Voucher

When accountants create a receipt voucher in Tally, a notification appears for all invoices with pending payments. The receipt may be revised with the payment method specifics as soon as the customer pays using any channel.

Furthermore, the consumer can receive all of the receipt’s data. Receipt vouchers make payment tracking simple.

Contra Voucher

Contra vouchers are required to draw or put money in banks using methods like cheques, ATMs, and DDs, or to e-transfer money to some other account using NEFT/IMPS.

Accounting professionals can also produce deposit slips for documentation using Tally’s contra vouchers. Tally also allows you to view and print the deposit slip while depositing the money.

Also Read: All About Vouchers in Tally

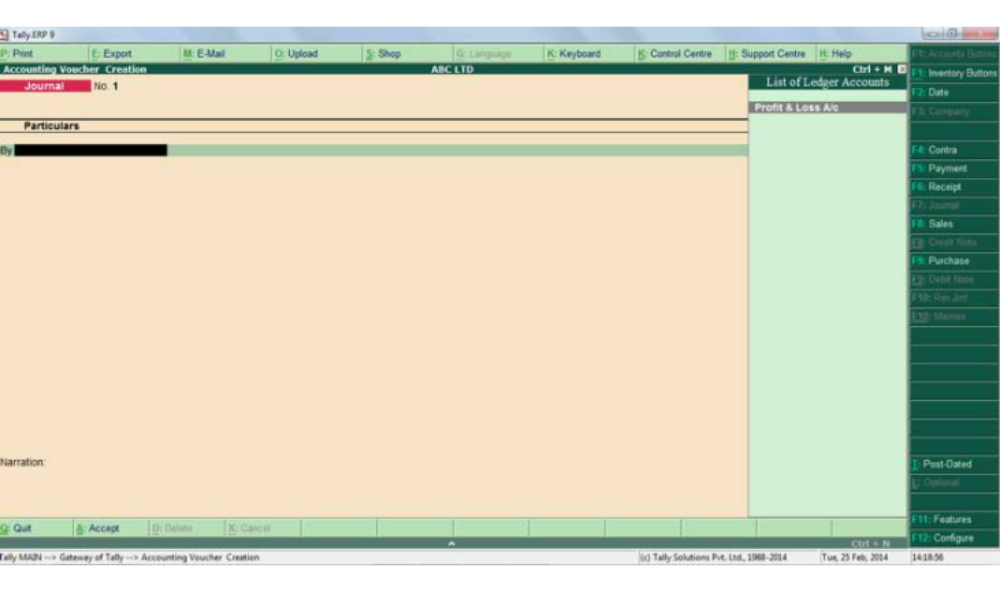

Journal Voucher

Though not a regular feature in Tally, a journal voucher may be used for both accounting and inventory purposes. This voucher may be utilized in a variety of ways in Tally, based on the nature of the business.

Accountants may use it as a supplementary voucher in Tally to facilitate sales and purchases. It can also be used by professionals to change or transfer inventory from one facility to another.

Sales Voucher

Tally’s sales voucher is among the most commonly used accounting vouchers. It may be created in two distinct manners: as an invoice or as a voucher.

Users can take a printout of invoices for consumers using the invoice format. The voucher format can be used to digitally retain trade records and does not require a physical copy for the customer.

Types of Sales Entry

Sales of Goods and Services

Sales of goods or services are indeed an important component of any business. Your company’s sales activities might be simply cash sales or even credit sales. It is vital to maintain a log on the sold items, the payment received, items that were returned, etc, for each and every transaction.

The invoice also acts as evidence of the operations that happened between a buyer and a seller. You can perform all of these things and more with Tally.ERP 9. Furthermore, you may access reports at any time to learn more about your company’s sales success.

- Sales Bill Generation: Entering the sales of goods and services in Tally allows you to document a cash bill or an invoice in cases where buyers make an immediate payment using either cash or other modes like a card.

- Printing of Invoices: The software allows the user to hand their customers a copy of the invoice. Users can include precise details, such as the capacity of a machine when printing these invoices. Moreover, these invoices are useful as a piece of a document that bears the address of the buyer to avoid any confusion.

- Keep a log of additional charges, discounts and free items: Extra expenses, such as shipping, insurance, discounts, and duties, may be included in our sales transaction. You may have to add discounts to every article or to the whole bill amount, in your accordance with organisational procedures.

Likewise, if you sometimes offer free goodies to your customers or send samples to them, all of this may be monitored and documented in Tally. - Reports: Many reports, like that of Sales Register, Day Book, and so on, may be used to record all of the sales bills entered in Tally.ERP 9. You may evaluate your sales over time, sort the data for relevant details, and customise the reports to see more sales-related information, among other things.

How to enter records of Sales of Goods and Services?

The method in Tally.ERP 9 is the same whether you perform cash or credit sales. The sole distinction is that for cash transactions, you will choose cash or bank, while for credit sales, you will use a party ledger.

You can use the Item Invoice mode to track product sales and the Accounting Invoice mode to generate bills minus the items. Tally.

ERP 9 now gives you the option of documenting sales using these invoicing formats alternately. You may print all of the invoices with the relevant information according to your corporate standards.

- Navigate to the sales voucher screen

- Select ‘Gateway of Tally’, click ‘Accounting Vouchers’ and press F8 (sales)

- Hit Alt+I and choose invoice mode

- Enter buyer’s information

- Choose the appropriate accounting ledger for assigning items in stock

- Enter details of stock

- Check and choose additional ledgers if needed

- Fill in ‘Narration’ if required

- You can press Ctrl+A to save the changes

- If you want to take a printout of the invoice, press Alt+P

Sales Returns

Tally records a sales return if the business person has sold goods and the customer has returned some or all of them. This entry is used to log transactions once the seller has accepted the returned products, whether before or after receiving payment.

How to enter records of Sales Returns?

- Press F11, go to F1 (Accounts) and toggle the button as yes against ‘Use debit and credit notes’ to enable the credit note feature

- Log on to the credit note voucher screen

- Fill in the buyer’s information

- Pick a sales ledger you want to allocate the stock items to

- Click on the bill wise details

- Save the changes. You can use Ctrl+A to do so

Sales Order

With Tally ERP9, just like the normal procedure you wish to follow in your everyday business, you can document your sales orders, raise delivery notes and link them to this order as well as link them to the sales invoice.

With the report viewing feature you can keep a track of outstanding sales orders. You can also use this software to make and take a printout of any sales order as a quotation without affecting your monthly books. It also allows you to pre-close the orders if you deem fit.

Here is how you can make a record of Sales Order

- Hit on the F11 (Features) button and click on F2 (Inventory). Select the ‘Yes’ option against ‘Enable sales order processing

- Navigate to the sales order voucher screen

- Login the information of the buyer

- Fill in the sales order number for the voucher

- Pick the appropriate sales ledger to allocate the stock items

- Provide additional stock item details such as the due date and quantity

- You can pick any additional letters if you feel necessary

- You can also give narration if needed

- You can take a printout of the sales order

Sale of fixed assets

Tally allows you to document the sale of fixed assets as well as transactions related to them.

How to record the Sale of Fixed Assets?

- Click on the sales voucher window

- Provide the asked buyer information

- Fill in the information related to the fixed asset

- Provide narration, if necessary

The trading account and sales register will bear this sales value.

Point of sale

Transactions like the point of sale usually happen at retail stores or check-out counters. Some point of sale equipment that many readers must have interacted with within their day-to-day life includes cash registers, card readers, and barcode scanners.

A point of sale invoice can be recorded in either single or multiple payment modes in Tally and can also be printed if necessary. The reports display the history of transactions and the software allows you to create a voucher for it.

How to record a POS invoice?

- Open up the voucher type window and select ‘Voucher types’

- Make sure that you have enabled voucher type for POS transactions

- The window will now prompt you to fill in the details of stock items

- Provide payment details

- Save the changes and exit

- Here you can print the invoice

Manage Buying and Selling Prices

You could wish to keep the rates so that they display immediately when you execute a transaction predicated on the purchasing and selling rates of each stock item. You may perform this in Tally. ERP 9 by giving each stock item a standardized value for buy and for sales.

You may set prices for inventory goods on a routine basis, depending on your business demands. The standard cost and standard price for that inventory item will display automatically when you enter the purchase and sales invoices.

Moreover, depending on the type of consumer or your inclinations, you may choose to set the selling price of goods at varying rates to different consumers. You may create a pricing list in Tally.ERP 9 to do this.

How to manage buying after adopting a standard price?

- Click open the stock item alteration window and press F12 to configure and put in the standard costs

- Specify the date these costs will be applicable and the rate per unit

- Select and save by pressing Ctrl+A

- It is done!

How to manage purchases after adopting a standard price?

- Click to open the purchase voucher screen and put in the supplier invoice number with the date

- Enter the supplier’s information

- Choose an appropriate Purchase ledger for assigning the stock items

- Click on any additional ledgers if the need be

- You can provide narration if necessary

How to set a price list?

An up-to-date price list supports corporate decision-making and speeds up the sales operation. When you have multiple pricing frameworks for different reasons, you may need one or more price lists.

You may generate a quantity-based pricing list with the desired discount scheme in Tally.ERP 9. You will need to generate the necessary pricing levels and attach various price lists to each of them. Price lists for stock items, stock groupings, and stock categories can be created.

- Press F11, select F2 for inventory And click on yes for ‘Use multiple price levels’

- Create a price list

- Provide additional details of this price list

Also Read: How To Auto Calculate GST Using Tally

Ledgers You Must Have Before Making Sale and Purchase GST Entry in TallyPrime

Ledgers that you should make before making purchase and sales entry in Tally with GST.

| Purchase Entry | Sales Entry |

| Intrastate Purchase (CGST and SGST) | Intrastate Sales (CGST and SGST) |

| Interstate Purchase (IGST) | Interstate Sales (IGST) |

| CGST (Receivable) | CGST (Payable) |

| SGST (Receivable) | SGST(Payable) |

| IGST (Receivable) | IGST(Payable) |

| Supplier/ Vendor Ledger | Customer / Sundry Debtor Ledger |

Maximize Your Online Business Potential for just ₹79/month on Lio. Annual plans start at just ₹799.

How can Lio help?

Lio is an app that organizes your data and improves organizational access to it, allowing end-users to exchange data more efficiently and decisively within the company.

This application, which is offered for smartphones, tablets, and PCs, assists in finding quick solutions to database queries, enabling data access quicker and more efficiently.

It assists in the formation of a framework for data quality activities. As a result, higher-quality data aids in the organization’s ability to make smarter, quicker decisions.

Step 1: Select the Language you want to work on. Lio on Android

Step 2: Create your account using your Phone Number or Email Id.

Verify the OTP and you are good to go.

Step 3: Select a template in which you want to add your data.

Add your Data with our Free Cloud Storage.

Step 4: All Done? Share and Collaborate with your contacts.

Conclusion

Tally ERP 9 has been revealed to be the most useful tool for a variety of accounting tasks. The software supports a number of different voucher forms. It serves in the tracking of various trade and transactions. The records will be retained for future use.

Every business makes money by selling goods and services after customers have made a purchase. Every company’s sales department has grown in importance. Tally software helps in tracking the movement of an organization’s cash and credit sales.

Frequently Asked Questions (FAQs)

How to create a POS Invoice in Tally ERP 9?

1. To create a POS Invoice, open up the gateway and navigate to Accounting Vouchers

2. F8: Sales > POS Invoice > POS Class

3. Pick a Godown

4. Fill in the party’s details

5. Choose a Sales Ledger

6. Enter stock item details

7. Choose the option reading GST ledgers from the dropdown of Ledger Accounts

8. Save

Is there any price list for purchases?

No, currently there are no price lists for purchases.

How to print two sales invoices on one page?

1. Choose the ledger that you wish to print

2. Press Ctrl+P

3. Select a printer and hit Enter

4. Under the option of ‘Page Format’, Select ‘Pages per sheet’ as 2

5. Print

How to scan barcodes in TallyPrime?

Hover your cursor over the field that reads ‘Stock Item Name/Particulars’. That should allow you to scan a barcode.

Make sure that a standard compatible barcode scanner has been installed in the software before scanning.

How to display separate columns for discounts while preparing an invoice?

1. Hit F11 to display the Company Features Alteration

2. Select the option as ‘Yes’ against ‘Use discount column’

If this option is not visible, trying the ‘Show more features’ option should display it.

10 Comments

I run a small business. I’ve been finding it difficult lately to manage everything. Could you kindly advise me on how to keep accurate financial records for my small business?

Hello Irfan,

Keeping precise financial records is crucial if you own a business.

Maintaining up-to-date records doesn’t have to take a lot of time, and doing so can help your organization run more smoothly, save money, and expand.

Get the appropriate bookkeeping system for your company first. Make sure the system you select is simple to use and complements your regular activities.

A crucial component of bookkeeping is matching the data in your accounts to the transactions in your bank account. It makes sure all revenue and expenses are recorded and serves as a check to make sure everything balances. A company may incur expenses as a result of late payments, which can also slow down cash flow. It is crucial that you follow up as soon as you can by sending a second invoice and contacting to inquire about any problems.

I literally learned a ton of new things after reading your article. You have a fantastic knack of explaining everything in great depth.

Hello Poonam,

Thank you so much for your warm words.

I’m delighted you found this article both interesting and informative.

Enjoy your reading!

Please explain what a sales journey entry is. Thank you for your time and effort in providing so much information.

Hello Bismi,

thank you for your kind words.

A cash or credit sale to a customer is noted in a sales journal entry. It does more than just list how much money was spent on the transaction. Accounting adjustments to accounts like the Cost of Goods Sold, Inventory, and Sales Tax Payable accounts should be included in sales journal entries as well.

I hope this is clear.

Could you please provide a list of some top mobile scanning apps? I run a shop, and your suggestion would be helpful.

Hello Akshya,

Some of the top mobile scanning applications include Adobe Scan, CamScanner, Microsoft Lens, Tiny Scanner, and Pen to Print.

Kindly conduct additional research before making a decision.

Pls clarify what a journal entry for the sale of a fixed asset is.

Hello Ajai,

The journal entry credits cost and gain on sale of fixed assets while debiting cash received and accrued depreciation. The transaction will reflect any cash or receivables received as a result of selling the assets. As the fixed asset is no longer under the company’s control, the purchase price and accrued depreciation must be subtracted.